Welcome to our comprehensive guide on investing in buy-to-let in Paris. Explore lucrative opportunities in the Parisian real estate market. Whether you’re an experienced investor or a newcomer seeking to capitalize on the ever-growing demand for rental properties in Paris, we’ve got you covered.

Investing in Paris means investing in a vibrant real estate market with a high rental demand throughout the year. Rent costs are high, and you will benefit from very high property liquidity upon a future resale. These elements are essential for real estate investors, and Paris is always a no-fail choice when looking for a rental investment in Ile de France or France.

Why Choose Buy-to-Let in Paris?

Investing in Rental property in Paris has become a must-consider choice for investors looking for a high rental yield and a dynamic real estate market.

1. High Rental Yields

The Parisian rental market boasts attractive rental yields, ensuring a profitable return on your investment. The city’s year-round appeal ensures a steady influx of tourists, business travelers, and students, contributing to the consistently high demand for rental properties.

2. Long-Term Appreciation

Investing in buy-to-let apartments in Paris offers not just immediate rental income but also the potential for long-term appreciation. The city’s real estate market has demonstrated resilience and growth over the years, making it an appealing choice for investors seeking capital gains.

3. Diverse Tenant Pool

Paris attracts a diverse range of tenants, from tourists seeking short-term stays to expatriates and students looking for more extended rental periods. This diversity ensures a steady stream of potential tenants, reducing the risk of extended vacancies.

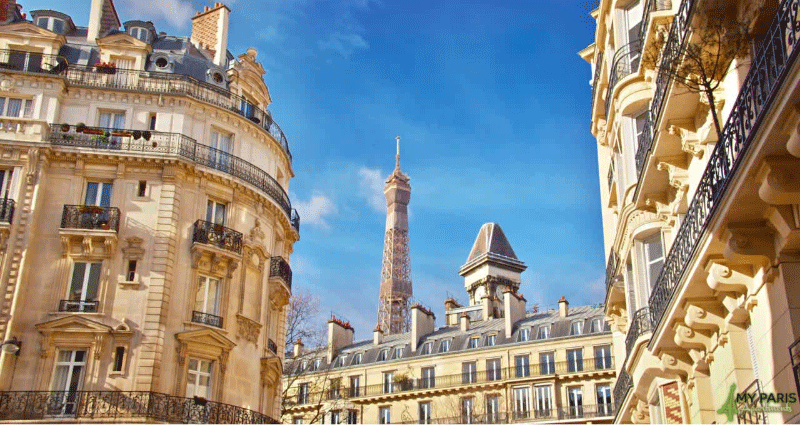

As you already know, the French capital is one of the most beautiful cities in the world. Paris is located in the heart of Europe and has a strategic location. It is a city known worldwide thanks to its economic dynamism and cultural richness.

It is also one of the first student cities in the world. Every year, Paris welcomes thousands of students, tenants, and investors. This capital city has many advantages to obtain the best possible rental investment in France. This is why I invest in Paris.

In this article, you will find out the key points to consider if you decide to make a rental property investment in Paris. For example, you will discover why Paris is a unique market, whether in terms of available properties, local economy and market prices, and the specificities of the Parisian real estate market.

I will also answer some of the usual questions of investors: what are the capital assets for a rental investment? Where to invest in Paris? Which district to choose? What is the price per square meter of real estate in Paris?

I will give you my secrets so that you can make the best possible buy-to-let investment in Paris. Let’s get started!

Buy-to-let investing in Paris in 2024: Specificities of the Parisian Real Estate Market

The Parisian real estate market is different from the rest of France. The primary cause of market tension is the lack of available supply compared to rental demand in Paris. This deficit is mainly responsible for the very high prices for both rentals and sales.

Therefore, the question for investors is to know the causes and whether this rental tension (measured by a real estate tension index ITI) will last. The specific characteristics of the capital have an impact on real estate purchase and rental investment projects.

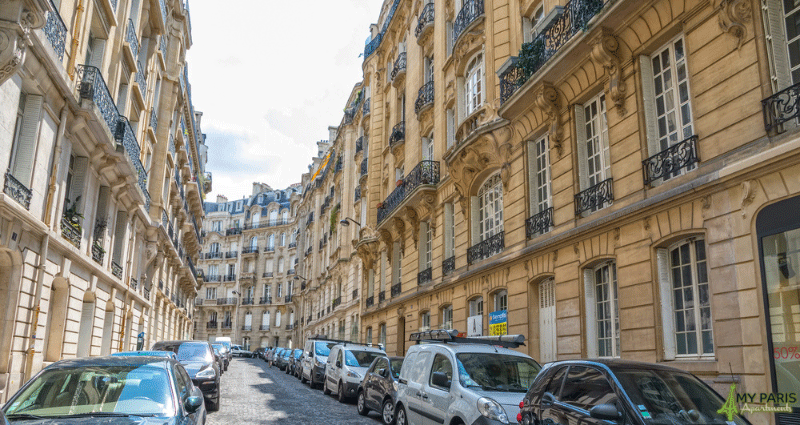

Paris offers minimal available land because of its old appearance, many historic buildings (Haussmannian, 1900s or medieval type), and minor surface area (in 2024). This explains why very few new buildings are being constructed in Paris intra-muros.

The Paris City Council mainly carries out a few new programs with a social housing destination. The other real estate projects are most often renovation projects or buildings built to replace dilapidated buildings, which does not increase the supply available on the market.

The demand for housing in the capital continues to grow while the supply needs to increase sufficiently. The deficit is growing, and rental tension remains very high. In this context, the interest for buy-to-let investors in old Parisian buildings is high.

Real estate investment in Paris: in 2024, the choice of an economic capital

One of the first elements to consider for the real estate investor is the economic dynamism of the capital and the Paris region, which is one of the strengths of the French capital. And this is even more true in times of crisis (post-Covid) since the French need jobs, which are found primarily in large cities.

Today, the Paris metropolitan area is one of the most dynamic economic centers in the world. It is one of the five largest metropolises in the world, and the evolution of its economic fabric, particularly its position in the world of start-ups, gives us great hope for the future. It is an engine for French growth.

Paris is an economic and innovation capital

The city is home to the headquarters of 39 of the world’s 500 most powerful multinationals. The business district of La Défense represents 20% of the GDP of the Île-de-France region and is the world’s leading business district, with three million square meters of office space and 150,000 employees. There are 1,500 companies, 14 of the top 20 national companies, and 5 of the top 15 worldwide.

In 2024, Paris will be the most attractive European capital for start-ups and investors. As a world leader in innovation, the French capital is a territory of invention that favors the development of projects by offering financial aid, accommodation, and support.

The city is attractive for innovative companies, as evidenced by the opening 2018 of Station F, a giant incubator created in the 13th arrondissement and financed by entrepreneur Xavier Niel.

This solid and dynamic Parisian economy attracts a large number of employees and executives who have housing needs :

1

Intelligence

Paris appears as one of the world’s leading places and ranks in the division of the world’s great intelligent cities. Paris is one of the three cities in the world to have won Nobel prizes in the five disciplines of physics, chemistry, economics, medicine, and literature.

2

The City of Light

Paris is a cultural and tourist attraction rich in culture. It is the capital of fashion, luxury, and gastronomy, even if it competes with other world metropolises. It ranks first in the world in terms of cultural facilities with its museums, theaters, operas, cinemas, theaters, parks and gardens, etc.

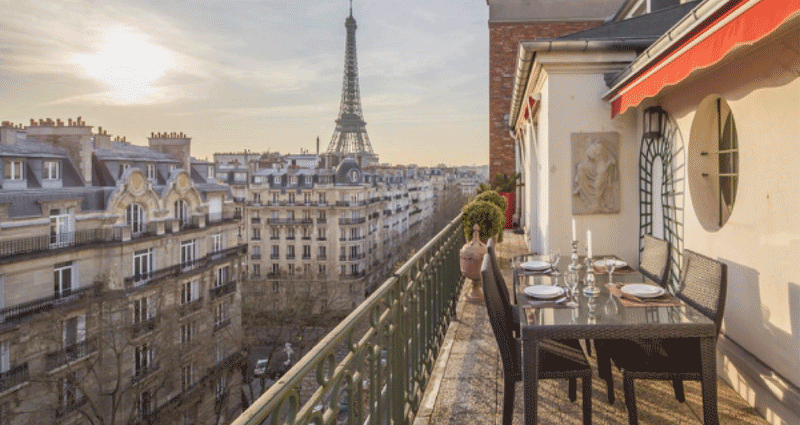

The image of the Parisian capital remains that of a “romantic” city, of a museum city with its downtown area, which makes it the first tourist destination in the world, with more than 47 million visitors per year.

The city of Paris is also said to be the world champion for public transportation, according to a study by the Institute for Transportation and Development Policy, “l’Institute for Transportation and Development Policy (ITDP).”

It is the best-served capital city, with three international airports, seven TGV stations, fourteen metro lines, and five RER lines. This means that 100% of Parisians live less than one kilometer from a train station, which makes life in Paris easy.

These economic elements are very encouraging if you wish to invest in Paris.

Paris is one of the world’s best university cities

This economic capital is also the leading student city in France and offers young people between the ages of 16 and 25 many opportunities to study or work.

Paris is the second-best student city in the world according to the 2018 “QS Best Student Cities” ranking, carried out for the past five years by the specialized firm QuacquarelliSymonds.

The French capital has many assets: First of all, its attractiveness, with a living environment that it offers to students in all areas, whether art, culture, and leisure. Also, the professional opportunities with jobs adapted for young graduates will discover thanks to the diversity of companies established in Paris and the intense concentration of prestigious universities and international establishments.

In Paris, Polytechnique, HEC, and ENA are ranked 4th, 5th, and 6th in the list of the best international institutions that train the leaders of the largest companies.

The number of students in Paris continues to grow, increasing by 25% between 1999 and 2016. Three hundred thirty-eight thousand students at the start of the 2015-2016 academic year, and today 500,000 young people are studying in Greater Paris, of which two-thirds (64%) are enrolling or continuing their studies in a Parisian institution.

In addition, more students are now studying for more extended periods, which impacts rental investment projects, as rental demand remains tight and rental vacancy is minimal.

Paris: Strong rental demand pushes prices up

Paris, the city of light that makes people dream, is one of the world’s most beautiful cities. It attracts buy-to-let investors who do not like taking risks, is a safe bet, and allows them to secure their investment assets.

These investors compete in the Parisian real estate market with French people looking for housing close to their place of work. As we discovered earlier, Paris is one of the best student cities (2nd best student city in the world in the QS Best Student Cities ranking of February 2018) and also the French economic capital, which attracts many companies.

Thus, in 10 years, Parisian real estate prices have increased by 52%! The forecast for 2024 is an increase of +2% to +2.5% in the price per square meter in Paris for purchases in the former (source notaires).

The tenant/owner ratio favors real estate investors: 64% of Parisians are renters, significantly higher than the national average of 43% of renting households (source: INSEE). This figure should be studied closely regardless of the city since tenants are your immediate customers. The demand, therefore, depends in part on this ratio.

The shortage of housing supply, which is far lower than demand, explains the high real estate prices in Paris compared to the rest of the French market. Thus, in 2024, the capital’s average price per square meter was over €10,200 per square meter for an apartment.

It varies between 9,000 € / hem² and 14,000 € / m² depending on the district and the neighborhood. Therefore, It is essential to study the market carefully to know where to invest in Paris, depending on the approach you wish to give to your rental investment project.

The impact of short-term rentals in Paris and the tourism economy

The attractiveness of the most beautiful city in the world remains very strong, despite a slight drop in the last two years due to tragic events. In this context, and with the arrival of short-term rental websites, many individuals have chosen to offer their properties for seasonal rental in Paris.

Thus, 90,000 properties are shown on the Airbnb platform alone in the Ile de France. That many properties are not offered for long-term rental.

Each property marketed to tourists is not offered to a Parisian resident or a would-be Parisian resident. These recent new uses (the explosion of this type of rental dates back to 2014) contribute to the decrease in the supply of long-term rentals.

Therefore, another aggravating factor is the need for more rental offers on the Parisian market. As for the question you are asking yourself, namely whether you should invest in short-term rentals, we advise you against it as it has become complicated, but this will be the subject of a dedicated article.

Property rental yields in Paris: from 3 to 5% gross, depending on the area

As a real estate investor, you should remember that the amount to invest to become a property owner in Paris, which we also call the entry ticket, is higher than in the provinces.

For an apartment of about 15 m2, you will have to spend about €210,000, all included (with notary fees, furniture, and renovation), and about €250,000 for a T2. This is an element to be taken into account.

Thus, the rental yield in Paris can reach 5.50% gross if you invest in an old property, renovate it, and furnish your property.

Except in exceptional cases, we advise our clients against investing in Paris under the Pinel program, which does not offer sufficiently high returns, even with the tax advantage.

What type of apartment should I choose to invest in Paris?

Now that you know the economic situation and the real estate market in Paris, you must choose the right product for your investment.

Demand is strong, but it also depends on the type of apartment to rent. Let’s find out which property types offer the highest rental yield in Paris while having excellent liquidity on resale.

Investing in a studio apartment in Paris is a perfect option. Small surfaces are often synonymous with high profitability. In concrete terms, the amount of Rent per square meter is higher for a small area than for a large apartment with the same services.

We advise you to choose a small surface-of-type studio in Paris or T2 according to your budget, allowing a better rental return. Larger areas should be used for shared accommodation to give you the highest rental return. The type of property you choose should always correspond to your target tenants.

Where to invest in Paris? Which district to choose? Which section to avoid?

Where to invest in Paris? Which district of Paris to choose for my real estate investment? If you have ever seriously considered investing in capital, you have asked yourself these questions. This is the case for all the investors I accompany.

And the question of the best district has several answers.

As in all real estate markets (Marseille, Lille, Lyon, etc.), there are areas to be favored for an attractive rental yield and other regions for investors who prefer the patrimonial aspect. It depends on each investor’s expectations, financial situation, objective, and investment horizon.

Our property hunters in Paris have excellent knowledge of the Paris market. Imagine having dedicated research tools and spending 50 hours a week looking for the best opportunity. That’s what we offer with our unique service for investing in Paris.

Depending on the objective of your rental investment in Paris, you can invest in an up-and-coming district or a more bourgeois district. Each arrondissement has its living environment, with a more or less active neighborhood life and public transportation, and most are well-equipped with shops.

This is also the case for art deco buildings. They are sure values on the market. But the price per square meter in these districts is very high.

They are reserved for investors who prefer a patrimonial logic, which means a lower return for a solid demand that will facilitate the resale.

You must turn to the more popular districts to obtain a higher rental return in Paris. For example, you can invest in the 18th, 19th, or 20th arrondissement.

These up-and-coming neighborhoods still need to be more attractive than the single-digit arrondissements. Thanks to our services, this type of district will allow you to obtain high returns between 5.00% and 6.00% gross.

Whatever the district, the method for obtaining a high rental yield is always the same: buy a property to renovate with a discount compared to the market. Then turn it into a high-quality property. A favorite property, thanks to careful renovation and professional decoration.

Keep in mind that in each district, some neighborhoods are better valued than others. Everything can change from one street to another. Always consider the following aspects: proximity to shops, transportation, schools, and universities.

Real Estate Investment in Paris: Concrete Examples

Here are some examples of rental investments made in 2024 in Paris. Our customers carried out these operations within the framework of our services to the council in rental investment. They have delegated us the entire process, from the search to the rental, through monitoring the renovation and decoration.

Studio in Paris 14th

Here is a studio renovated in a rising district of the 14th district of Paris.

After a complete optimization realized by our team, this property has delivered a yield of 4,7% gross to our client since 2018. The real LMNP tax system will allow him to pay no tax on rental income for about ten years. So a net yield of nearly 5% for a property in the 11th district of Paris in 2020. Not bad, right? 🙂

Two-bedroom apartment in the 15th district

For this apartment, we change districts. Our client contacted us as part of our real estate investment consulting service in Paris with a desire to invest in an intermediate district. He wished to invest in a one-bedroom apartment while benefiting from a higher rental yield than the market. Our team carried out this project in the 15th arrondissement, and the apartment delivers more than 5% return.

What is the budget for a real estate investment in Paris?

The minimum entry ticket for a studio in Paris, with an average agency in Paris, is about 210,000 €, all included. With this budget, you will have a fully renovated, optimized, and furnished studio.

This includes the purchase, notary fees, complete renovation, and furniture/decoration. This budget will allow you to have about 10.000€ of annual rental income.

Of course, some investors with smaller budgets will choose to rent a maid’s room. These apartments can be rented from 9m² minimum or 20m3.

Investing in Paris becomes more flexible for larger budgets, of course. Thus we propose apartments of type T2 starting from 250.000 € approximately, of the co-ops and cuttings starting from 350.000€ approximately.

For luxury properties, the entry ticket is high in Paris, starting at a minimum of €3 million, which generally excludes individual investors.

Prices per square meter in Paris

To make a real estate investment, you must know the market well. It would be best to find the prices per square meter in Paris. And they depend on the arrondissements and neighborhoods.

There are 20 arrondissements in Paris, divided at a snail’s pace on both sides of the Seine: the Right and Left Bank. The 1st to 7th arrondissements are the most expensive in Paris, with an average price between €12,000 and €17,000 per square meter in January 2024.

The 18th, 19th, and 20th arrondissements offer average prices below €10,000 per square meter, which is more reasonable and the least expensive in the capital.

The average price per square meter of apartments in the other districts is between 10,500€ and 14,000€.

It should also be noted that in the same arrondissement, the average price per square meter can vary considerably from one neighborhood to another, from one street to another, but also according to the type of building and the property.

Prices in Paris are constantly on the rise, as you can see from this graph showing the evolution of property prices in Paris between 1980 and 2019.

The impact of government rent control thresholds in Paris

To allow Parisians to live in good conditions, the former Minister of Housing Cécile Duflot passed a rent control law called the Alur law. This law came into force in 2015.

The Alur law regulates rents according to the districts of Paris, divided into 80 zones. For each zone, depending on the type of property, a reference rent, and an increased reference rent indicate to the lessor the maximum amount of Rent to be applied. A rent supplement may be added to this amount.

This additional amount, which is very vague, must be justified by the location or comfort characteristics of the property. It must be mentioned on the lease.

No legal list of characteristics or rates can be applied, and good practice consists of renting a property at a fair price. This means that a property with an additional rent must be worth its price, which I advise my clients to do.

Paris real estate market: 2024 outlook

The Parisian real estate market has risen sharply in 10 years (+ 21.6%). After a substantial rise in 2019 (+9.80%), 2020 started off very well before a sharp halt during the containment period.

The post-confinement recovery shows prices holding steady even if volumes are logically down. The notaries anticipate a continuation of the rise in the capital for 2024. Prices per square meter in Paris should continue to rise.

As for rentals, there is nothing new under the Parisian sun. Rental demand remains strong even though rental prices seem to have stabilized. The number of students, especially international students, continues to grow, and the economy is booming with increased businesses being created in Paris.

Thus, the economic fabric of Paris, its growing demographics, and its increasing rental demand will continue to mobilize the interest of rental investors in the coming years.

Frequently Asked Questions

Is Paris a good place to invest in real estate?

Paris, the City of Lights, has long been a magnet for investors seeking lucrative opportunities in the real estate market. With its rich history, iconic landmarks, and vibrant culture, Paris has consistently proven to be a sound choice for those looking to capitalize on the benefits of real estate investment.

Paris boasts a remarkably stable real estate market, even during periods of economic uncertainty. The city’s enduring appeal attracts a constant stream of both local and international demand, ensuring a relatively steady market and mitigating the risks associated with real estate investments.

–

Can you buy-to-let in France?

Yes, it is possible to buy-to-let in France. The buy-to-let strategy involves purchasing a property with the primary purpose of renting it out to tenants, generating rental income, and potentially benefiting from property appreciation over time.

France offers a favorable environment for buy-to-let investors, attracting both domestic and international individuals seeking to invest in the real estate market.

–

Is buy-to-let still worth it in 2024?

Whether buy-to-let is worth it in 2024 or any other year depends on various factors, including the specific real estate market conditions, economic trends, government policies, and individual investment goals.

Research the current state of the real estate market in the area where you are considering a buy-to-let investment. Analyze factors such as property prices, rental demand, vacancy rates, and projected property appreciation.

–

Can foreigners own property in Paris?

Yes, foreigners can own property in Paris, as well as in the rest of France. France has a liberal property ownership policy, allowing non-residents to purchase and own real estate in the country.

This includes individuals from other countries who wish to invest in residential or commercial properties in Paris.

Foreigners have the same property ownership rights as French citizens, and there are no restrictions on foreign ownership of residential or commercial properties.

Whether you are looking to buy an apartment, house, or commercial property in Paris, you are generally free to do so without any legal barriers.

–

How do you buy property in Paris?

Buying property in Paris follows a process similar to purchasing real estate in other parts of France. Here’s a general guide on how to buy property in Paris:

1. Determine Your Budget and Preferences: Before beginning your property search, establish a budget for your purchase. Consider factors such as the type of property (apartment, house, etc.), size, location, and any specific features you desire.

2. Engage a Real Estate Agent: It is highly advisable to work with a qualified and experienced real estate agent who specializes in the Paris market. They can help you navigate the local market, identify suitable properties, and negotiate on your behalf.

3. Property Search: Your real estate agent will present you with a selection of properties that match your criteria. You can also search for properties online through various real estate websites and listings.

4. Property Viewing: Arrange viewings for the properties you are interested in. Take your time to inspect each property thoroughly and consider its proximity to amenities, public transport, and other relevant factors.

5. Make an Offer: If you find a property that you want to purchase, your real estate agent will help you make an offer to the seller. The offer will include the proposed purchase price and any conditions you may have, such as the inclusion of specific furniture or appliances.

6. Sign a Preliminary Sales Agreement: Once your offer is accepted, you will typically sign a “compromis de vente” or preliminary sales agreement. This agreement outlines the terms and conditions of the sale, including the purchase price, completion date, and any suspensive conditions (e.g., obtaining financing).

7. Secure Financing (if needed): If you require financing for the purchase, you will need to secure a mortgage from a French bank or a lender in your home country. Your real estate agent or financial advisor can assist you with this process.

8. Notary and Legal Procedures: In France, property sales are completed by a notary who handles the legal aspects of the transaction. The notary ensures that all legal requirements are met, conducts necessary searches, and prepares the final deed of sale.

9. Finalize the Sale: On the completion date specified in the preliminary agreement, you and the seller will sign the final deed of sale at the notary’s office. At this stage, you will pay the remaining balance and any associated fees (e.g., notary fees, registration fees).

10. Property Transfer: After the final signing, the property officially becomes yours, and you will receive the keys to your new Parisian property.

Keep in mind that the specific steps and requirements may vary based on individual circumstances, property type, and any changes in regulations. Therefore, it is essential to work closely with your real estate agent and notary throughout the process to ensure a smooth and successful property purchase in Paris.

–

Is it good to invest in real estate in France?

Investing in real estate in France can be a compelling opportunity for various reasons, making it a popular choice among domestic and international investors.

However, like any investment, there are both benefits and considerations to keep in mind. Here are some factors to consider when evaluating whether it is good to invest in real estate in France:

Benefits of Investing in Real Estate in France:

1. Stable Real Estate Market

2. Diverse Investment Opportunities

3. High Rental Demand

4. Favorable Financing Options

5. Economic and Political Stability

6. Quality of Life

Considerations for Investing in Real Estate in France:

1. Taxation

2. Legal and Administrative Procedures

3. Currency Risk

4. Regional Variations

5. Economic Factors

6. Tenant Rights

Ultimately, the decision to invest in real estate in France depends on individual circumstances, investment objectives, and risk tolerance.

Engaging the expertise of a local real estate agent and seeking advice from financial professionals can help investors make informed decisions and capitalize on the opportunities that the French real estate market has to offer.